Leading Debt Consultant Services Singapore: Secure Your Financial Future

Leading Debt Consultant Services Singapore: Secure Your Financial Future

Blog Article

Open the Conveniences of Engaging Financial Obligation Professional Solutions to Navigate Your Path Towards Debt Relief and Financial Liberty

Engaging the solutions of a debt consultant can be an essential action in your journey in the direction of achieving financial obligation alleviation and monetary security. These specialists provide customized approaches that not only assess your distinct financial scenarios but likewise give the necessary advice required to browse intricate arrangements with lenders. Comprehending the multifaceted benefits of such expertise might expose choices you had not formerly taken into consideration. Yet, the question remains: what particular benefits can a financial debt specialist offer your monetary situation, and just how can you determine the ideal partner in this endeavor?

Comprehending Financial Debt Expert Solutions

Exactly how can debt specialist solutions transform your monetary landscape? Debt professional services provide specialized assistance for people facing financial challenges. These experts are trained to analyze your economic circumstance thoroughly, providing customized methods that straighten with your one-of-a-kind situations. By evaluating your income, debts, and expenditures, a debt expert can assist you determine the source of your economic distress, allowing for a much more precise technique to resolution.

Financial debt consultants typically use a multi-faceted strategy, which may include budgeting support, settlement with financial institutions, and the growth of a calculated repayment plan. They work as middlemans between you and your lenders, leveraging their know-how to negotiate extra beneficial terms, such as minimized rate of interest or extensive settlement timelines.

Additionally, financial debt consultants are furnished with current expertise of appropriate regulations and laws, guaranteeing that you are educated of your rights and alternatives. This professional support not just minimizes the psychological worry associated with financial obligation however also encourages you with the tools needed to regain control of your financial future. Ultimately, involving with financial debt professional solutions can cause a more organized and educated course toward economic security.

Key Advantages of Professional Support

Engaging with financial obligation specialist services provides many benefits that can substantially enhance your economic circumstance. Among the main benefits is the know-how that experts give the table. Their considerable expertise of financial obligation administration strategies enables them to tailor solutions that fit your special situations, making certain a more effective strategy to accomplishing monetary stability.

Furthermore, debt consultants frequently provide negotiation support with creditors. Their experience can cause extra desirable terms, such as minimized rate of interest or cleared up financial debts, which might not be attainable with straight settlement. This can lead to considerable economic alleviation.

In addition, professionals supply an organized strategy for payment, assisting you prioritize debts and allocate sources successfully. This not just simplifies the repayment procedure yet likewise promotes a sense of liability and progression.

Inevitably, the mix of professional assistance, negotiation skills, structured settlement strategies, and emotional support positions debt professionals as beneficial allies in the quest of debt alleviation and economic flexibility.

How to Pick the Right Expert

When choosing the right financial obligation consultant, what vital variables should you take into consideration to guarantee a positive result? First, analyze the expert's qualifications and experience. debt consultant services singapore. Look for accreditations from recognized companies, as these indicate a degree of expertise and understanding in the red administration

Next, think about the consultant's online reputation. Research study on-line reviews, endorsements, and ratings to assess previous clients' contentment. A strong record of successful financial debt resolution is necessary.

Additionally, examine the consultant's method to financial debt management. A great professional should use personalized services customized to your one-of-a-kind financial circumstance as opposed to a one-size-fits-all solution - debt consultant services singapore. Transparency in their processes and charges is important; guarantee you recognize the costs involved before dedicating

Interaction is an additional vital factor. Choose a specialist that is eager and his explanation friendly to address your questions, as a solid working relationship can improve your experience.

Typical Financial Obligation Alleviation Methods

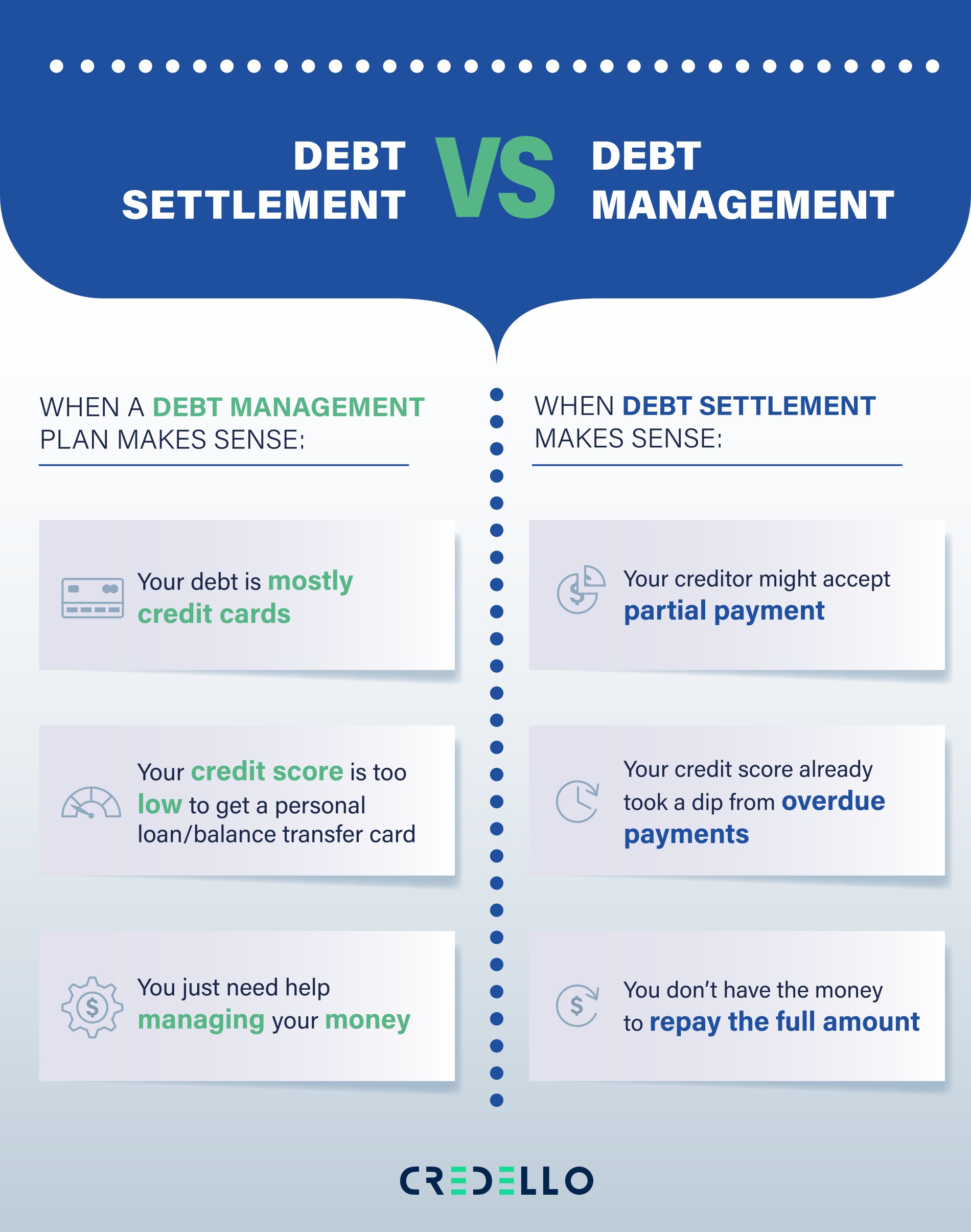

While different financial obligation relief methods exist, selecting the ideal one relies on specific economic conditions and objectives. Several of one of the most usual methods consist of financial obligation combination, financial obligation administration plans, and debt settlement.

Financial debt debt consolidation entails integrating several financial obligations into a solitary lending with a lower rate of interest. This technique simplifies payments and can reduce monthly commitments, making it easier for people to reclaim control of their funds.

Financial debt monitoring strategies (DMPs) are designed by credit rating therapy companies. They bargain with lenders to reduced rate of interest prices and produce an organized repayment strategy. This option permits individuals to settle debts over a fixed duration while taking advantage of specialist guidance.

Financial obligation negotiation involves bargaining directly with lenders to work out financial debts for less than the overall amount owed. While this strategy can offer instant relief, it might affect credit score scores and typically entails a lump-sum payment.

Finally, personal bankruptcy is a lawful option that can offer remedy for frustrating financial debts. However, it has long-term monetary ramifications and need to be considered as a last resource.

Picking the ideal strategy requires mindful evaluation of one's financial circumstance, making sure a customized technique to attaining lasting security.

Actions In The Direction Of Financial Liberty

Next, establish a reasonable budget that prioritizes essentials and fosters cost savings. This budget plan must consist of stipulations for financial debt settlement, permitting you to allot excess funds efficiently. Adhering to a budget helps grow regimented spending behaviors.

As soon as a spending plan is in location, take into consideration involving a debt professional. These professionals provide customized methods for handling and lowering financial debt, supplying insights that can expedite your journey towards monetary freedom. They might suggest choices such as debt combination or negotiation with creditors.

In addition, emphasis on building an emergency fund, which can stop future financial pressure and provide peace of mind. With each other, these actions create an organized approach to achieving economic flexibility, changing goals into truth.

Verdict

Involving debt professional solutions provides a critical method to accomplishing debt alleviation and financial liberty. Inevitably, the knowledge of financial obligation specialists considerably boosts the chance of navigating the complexities of debt management properly, leading to a much more safe financial future.

Involving recommended you read the services of a financial obligation consultant can be a pivotal step in your journey in the direction of achieving debt alleviation and financial stability. Debt consultant solutions use specialized assistance for individuals grappling with monetary difficulties. By analyzing your income, debts, and expenditures, a financial debt expert can help you identify the origin triggers of your economic distress, permitting for a much more precise technique to resolution.

Engaging financial obligation professional services offers a critical approach to accomplishing financial debt relief and economic liberty. Eventually, the expertise of financial obligation specialists significantly enhances the possibility of browsing the intricacies of financial obligation administration properly, leading to a more secure monetary future.

Report this page